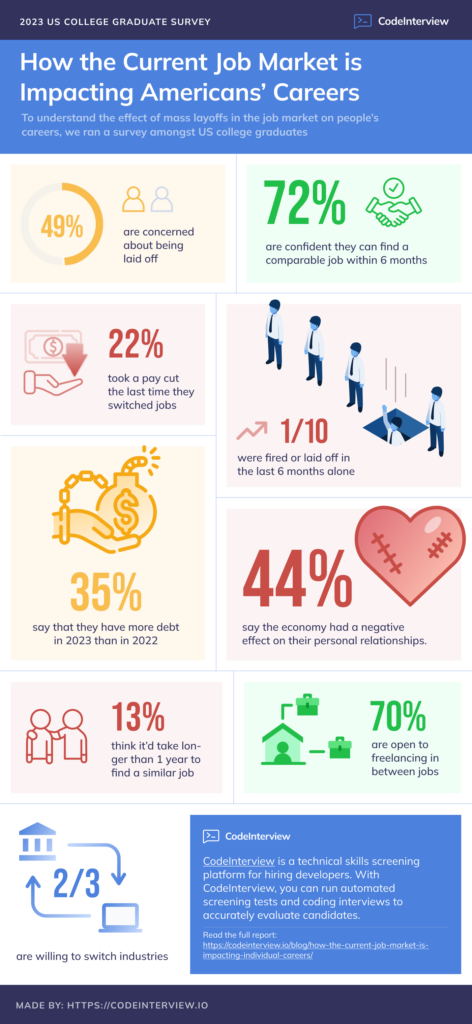

Report highlights

- 11% of the respondents were fired or laid off in the last 6 months alone

- 49% of respondents are concerned about being laid off.

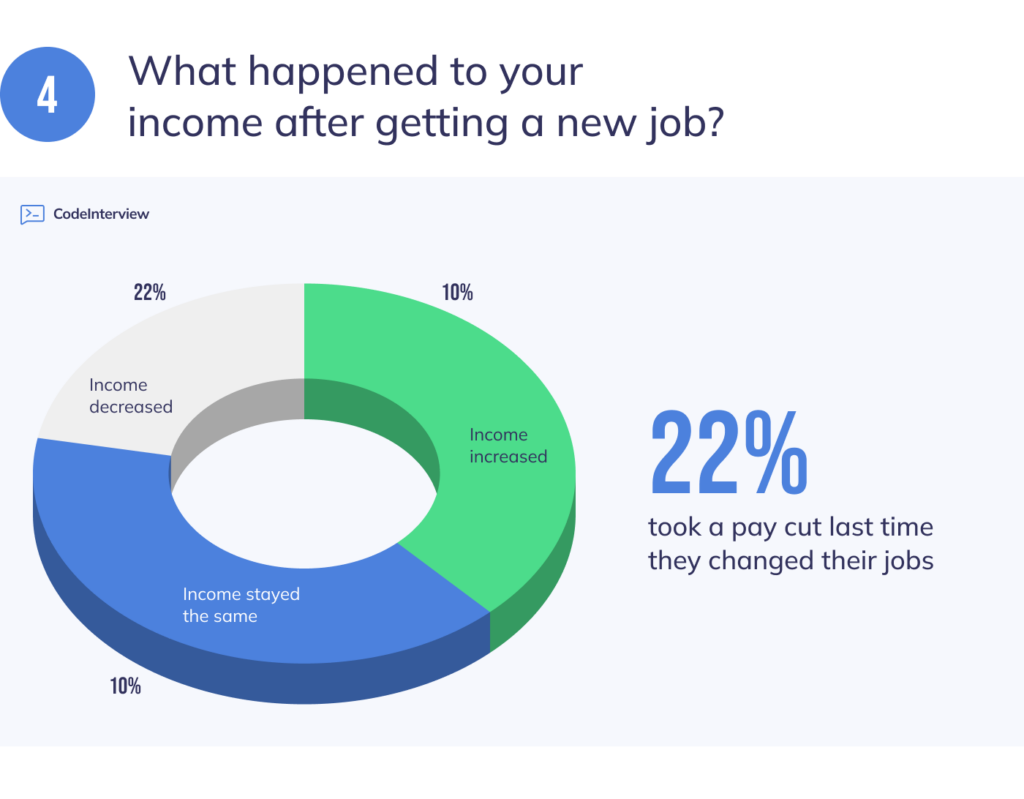

- Nearly a quarter took a pay cut the last time they switched jobs.

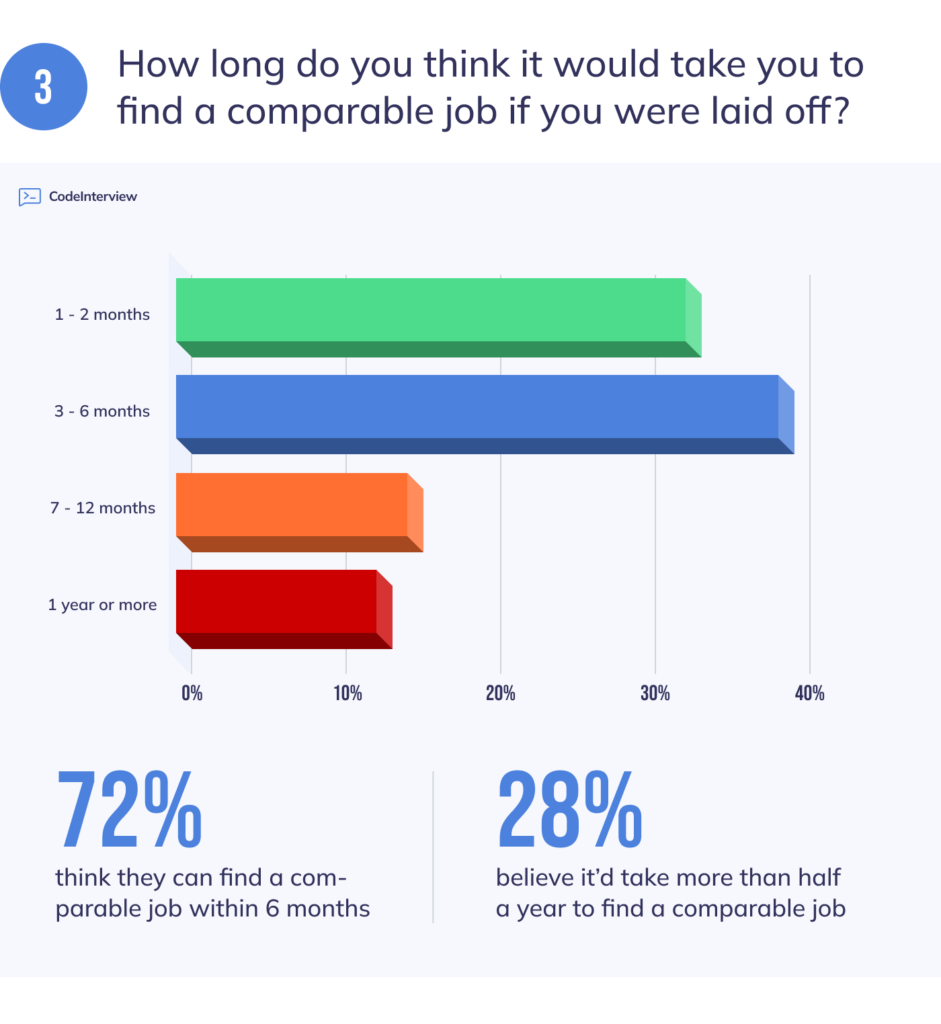

- Most respondents believe they can find a comparable job within 6 months.

- 13% believe that they will need 1 year or more to find a comparable job.

- Most respondents have the same levels of debt as in 2022.

- 35% have more debt in 2023 so far compared to 2022.

- 70% are open to freelancing in between jobs

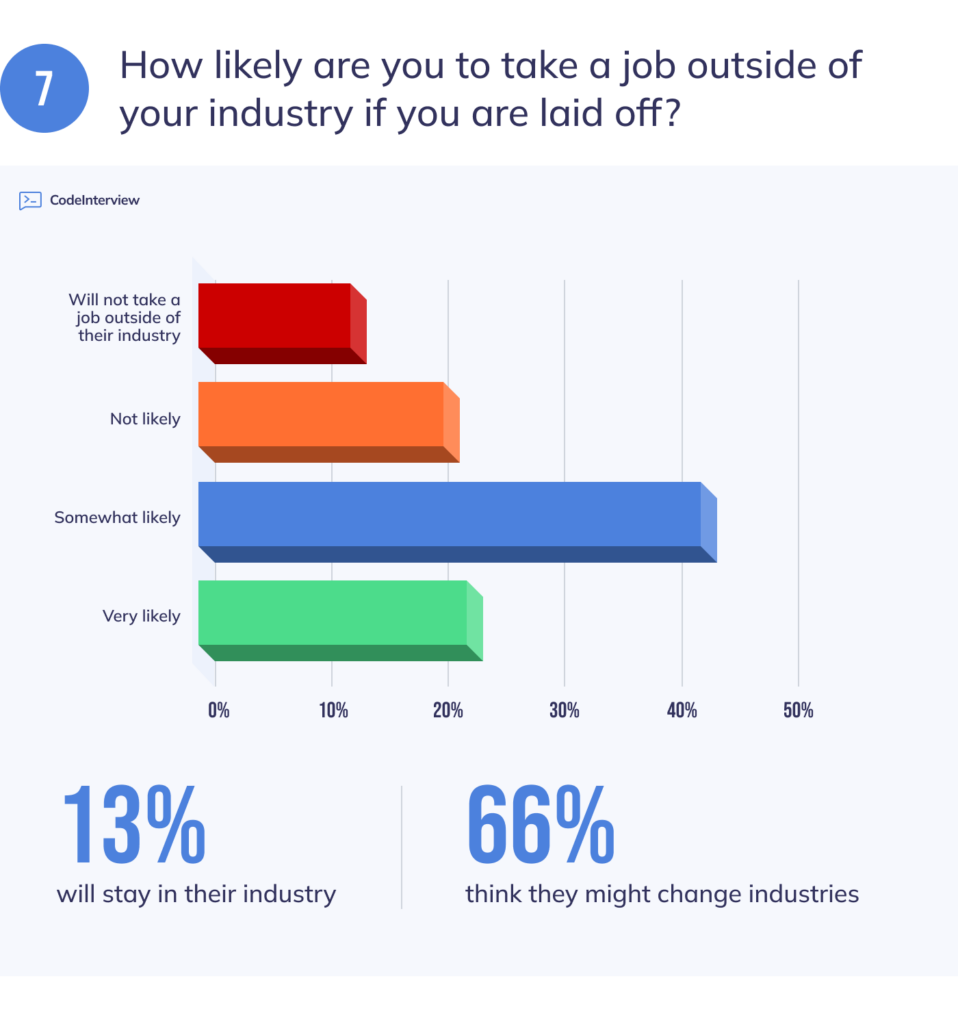

- Two thirds of respondents are willing to switch industries

- The economy had a negative effect on 44% of respondents’ personal relationships.

Share this Image On Your Site

About this report

Starting in late 2022, we’ve seen multiple layoffs at tech companies like Amazon and Meta, with Twitter reducing headcount by as much as 50%.

The situation is no different at smaller tech companies where VC funding dried out seemingly overnight, leaving many CEOs struggling to raise their next round and being forced to let people go.

While the tech sector was most impacted, things haven’t been too good for the wider economy as inflation and interest rate hikes are putting pressure on households and small businesses alike.

Still, the job market has not been affected as negatively as expected, despite what economic theory would dictate.

In order to understand the effect of this job market on people’s careers so far, we ran a survey amongst 559 US graduates aged 24-60+.

How many were laid off? Are they concerned about their career? What happened to their income? Read on to learn the answers to these questions, and more, below.

About CodeInterview

CodeInterview is a technical skills screening platform for hiring developers. With CodeInterview, you can run automated screening tests and coding interviews to accurately evaluate candidates.

11% of respondents were laid off in the last 6 months

We first wanted to see what’s the proportion of respondents that were directly affected by layoffs. This would allow us to compare our sample to the wider US population.

It turns out that 11% of participants were laid off or fired in the last 6 months alone (Sep 2022 – Feb 2023).

This compares to an estimated 4.7% of the overall workforce in the same period, indicating that our respondents (all of them college graduates) were more affected.

On a bigger scale, an estimated 15.4 million Americans were laid off in 2022 which is the lowest in the past 20 years. Take, for example, 2020 when the Covid pandemic led to an estimated 41.7 million layoffs.

Still, most layoffs took place in the second half of 2022, especially Q4, so the numbers in 2023 may look very different.

49% are concerned about being laid off

So, how does the combination of factors we mentioned (tech layoffs, interest hikes, inflation) impact people’s expectations about losing their job?

Almost half of our respondents said they are at least a little concerned about being laid off.

If 1 out of every 2 people is concerned about being laid off, this seems to indicate worry and low confidence in the economy.

72% believe they can find a comparable job within 6 months

While people are concerned about losing their job, most of our respondents believe they can find a comparable job within 6 months.

This is another sign of uncertainty about where the economy is headed – we have reasons for concern but at the same time there are plenty of jobs available.

Now, let’s see how income is affected after switching roles…

22% took a reduced salary after switching roles

It’s interesting to note that almost a quarter of our respondents took a salary reduction in their most recent job switch.

Considering inflation and a general move upstream when it comes to salaries, it’s a little concerning that so many people were willing to take a pay cut.

This indicates that a considerable part of respondents faced financial pressure in the short term so we also looked at the impact on their debt situation.

73% have more or the same level of debt compared to 2022

On the back of rising inflation and interest rates, many people (35.5%) actually took on more debt in 2022, while 37% had the same level of debt.

Again, this indicates confidence in the economy but does it reflect the reality of high costs of borrowing?

70% are open to freelancing in between jobs

The growing gig economy seems to provide an extra layer of optimism when it comes to filling the financial gap between jobs. Based on our results, freelancing is a viable alternative to supplement respondents’ income.

Still, only 7.7% of respondents said they are currently freelancing – that’s well below the US average of 36%. This could mean that freelancing is more common for people without a college degree.

66% are open to changing their industry if laid off

So we know 22% of respondents were willing to take a pay cut when switching jobs. But what about changing industries entirely? It turns out that two-thirds of our participants are open to switching industries if laid off.

Only 13% are firm on staying within the same type of company which means respondents are fairly industry-agnostic. So people tend to see their skills as transferable and don’t see staying within the same industry as a major benefit to their career.

44% saw a negative effect on their personal relationships

We included a more personal question to see how the economic situation impacts social relationships. 44% of our respondents said it had a negative effect.

This shows that economic conditions go hand in hand with personal relationships. For example, financial struggles, longer hours and relocation can all impact a person’s social connections.

Further reading: